If you’re running a business, a side hustle, or managing finances for a client, you’ve likely felt the pain of mixing your personal and professional money. The solution seems simple: just open a second Venmo account, right?

But here’s the catch: Venmo is not like a bank. It’s a social payment platform, and its rules are strict. The moment you try to create a second personal account, you’re playing a dangerous game with your funds and your financial future. The fear of getting flagged, investigated, or even permanently banned is a very real anxiety for anyone trying to scale their operations.

So, let’s answer the $60,000 question: Can you have multiple Venmo accounts? The short answer is yes, but only if you follow the rules. The long answer involves understanding digital fingerprints, antidetect browsers, and the only way to achieve true, risk-free multiaccount management.

We’re going to break down Venmo’s official policy, show you the safe, legal ways to separate your finances, and introduce you to the professional-grade solution that eliminates the risk of account bans.

The Official Answer: Can You Have Multiple Accounts on Venmo?

Let’s clear up the biggest misconception right away. Venmo’s User Agreement is very clear: you are only allowed to have one personal account.

This single account is your digital financial identity on the platform, tied to your unique phone number, email, and verified identity. Trying to create a second personal account—even with a different email address—is a direct violation of their terms of service.

Why is Venmo so strict? Because they are a regulated financial service, and they use sophisticated anti-fraud systems to prevent money laundering and other illicit activities. These systems look for patterns, and trying to create a second account is a massive red flag.

❌ The Risk You Can’t Afford: Attempting to bypass the one-account rule is a fast track to a permanent ban, which could mean your funds are frozen and you lose access to the platform forever. Don’t risk it.

The Phone Number Problem: Can You Have Multiple Venmo Accounts on One Phone?

This is a question we see all the time. Can you have multiple Venmo accounts on one phone?

You cannot create two personal accounts using the same phone number. The phone number is the primary unique identifier for your account.

However, you can log in and out of different accounts on the same device. For example, you could log into your personal account, log out, and then log into your Venmo Business Profile or a partner’s account.

But here’s the secret danger: Device Fingerprinting. Even if you log out, Venmo’s systems can see that two different accounts are being accessed from the exact same device, with the exact same digital signature. For an anti-fraud system, this is a massive red flag that suggests you might be trying to hide something.

The Safe Way to Scale: Can You Have Multiple Bank Accounts on Venmo?

If your goal is to separate your money, the good news is that Venmo is incredibly flexible when it comes to funding sources.

Yes! You Can Have Multiple Bank Accounts on Venmo

The answer to can you have multiple bank accounts on Venmo is a resounding Yes! Venmo allows you to link up to four different bank accounts to your single personal profile.

This is the official, safe, and smart way to organize your finances within the platform. You can use one bank account for receiving payments, another for paying out, and a third for a specific savings goal—all without violating a single rule.

How to Link Multiple Bank Accounts:

- Go to the “Settings” menu in the Venmo app.

- Select “Payment Methods.”

- Choose “Add a bank or card.”

- Follow the prompts for instant verification or manual micro-deposit verification.

The Official Loophole: Personal Account + Business Profile

If you need a second, completely separate financial identity, Venmo offers one official solution: the Venmo Business Profile.

This is the only legitimate way to have two accounts under your name. It’s designed for users who are selling goods or services and need to:

- Separate Transactions: Keep your business income clean and separate from your personal spending.

- Simplify Taxes: Receive a separate 1099-K form for your business transactions.

- Look Professional: Use a business name, profile picture, and unique QR code for customers.

Feature | Personal Profile | Business Profile |

Purpose | Friends, family, and trusted payments. | Selling goods and services. |

Fees | Free for standard payments. | Standard transaction fee (typically 1.9% + $0.10) for payments received. |

Account Limit | One per user. | One per user (linked to the personal account). |

Risk | Low, if used correctly. | Low, if used correctly. |

Why Advanced Users Need True Multiaccount Management (Beyond Venmo’s Rules)

Venmo’s official solutions are great for the average user. But what if you’re an agency managing 10 client accounts, or a professional who needs to run multiple, completely isolated e-commerce ventures?

The need for true multiaccount management goes far beyond what Venmo’s single-user, single-device model can safely handle.

The Digital Fingerprint Trap

Every time you log into an account, the platform takes a snapshot of your browser fingerprint. This is a unique profile made up of hundreds of data points: your IP address, time zone, screen resolution, operating system, and advanced technical details like Canvas and WebGL data.

If you try to manage multiple accounts—even legitimate ones—from the same computer, you are leaving the exact same digital fingerprint on every single one.

The Analogy: It’s like trying to trick a bouncer by wearing a different hat for each entry, but you keep using the same, unique set of fingerprints. They know it’s you, and they will eventually shut you down.

This cross-contamination is the number one reason why accounts get flagged, limited, or banned. It’s a risk that can cost you thousands in lost revenue and frozen funds.

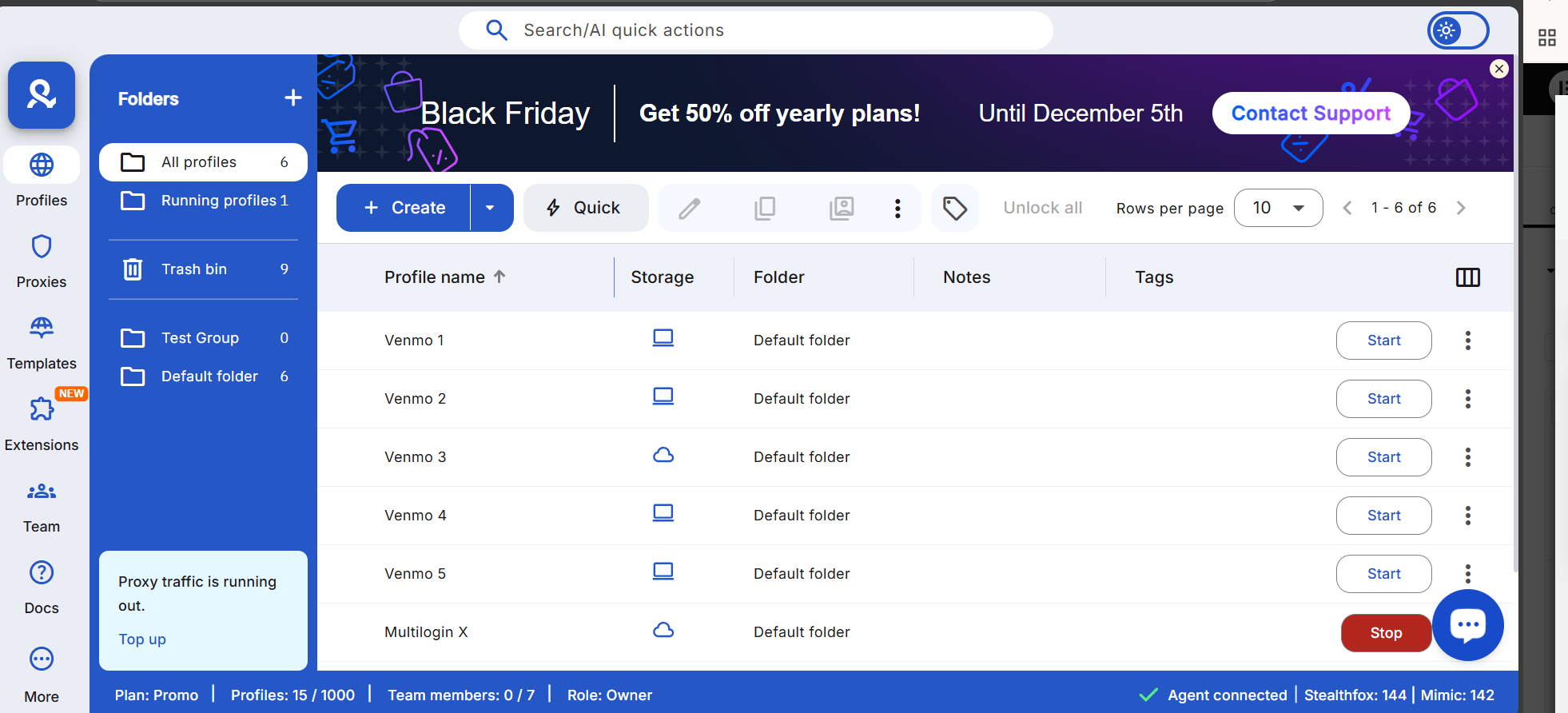

The Antidetect Browser Solution: How Multilogin Secures Your Venmo Accounts

For professionals who need to manage multiple, completely isolated digital identities, the only reliable solution is an antidetect browser.

What is an Antidetect Browser and How Does it Help with Multiaccount Management?

An antidetect browser is a specialized tool that creates a unique, isolated, and consistent digital identity for each account you manage. It’s not just clearing cookies; it’s creating a brand new, virtual computer for every single Venmo account.

Multilogin, the industry pioneer in this space, allows you to create separate browser profiles that are completely isolated from each other.

The Power of Profile Separation and Proxy Browser Integration

Here’s how Multilogin provides the peace of mind and undetectability you need:

- Unique Digital Fingerprints: For Venmo Account A, Multilogin creates a profile with a specific Windows OS, a unique set of fonts, and a distinct Canvas fingerprint. For Venmo Account B, it creates a second, completely different digital identity, perhaps a Mac OS with a different screen resolution. To Venmo’s anti-fraud system, these appear to be two different, legitimate users on two different computers.

- Proxy Browser Integration: Every professional knows that the IP address is crucial. Multilogin makes it easy to integrate a proxy browser solution. You can assign a dedicated residential proxy to each browser profile, ensuring that Venmo Account A is always accessed from a clean, unique IP address in New York, and Account B is always accessed from a clean IP in Miami.

- Consistency is Key: Multilogin ensures that each profile’s digital fingerprint remains perfectly consistent every time you log in. This is the hallmark of a legitimate user and the key to long-term account health.

Multilogin is the all-in-one solution for anyone serious about multiaccount management. Our technology is tested daily on over 50 websites to ensure complete undetectability.

👉 Don’t risk bans: Try Multilogin and keep your accounts undetected.

Frequently Asked Questions About Can You Have Multiple Venmo Accounts

Yes, but with a nuance. You can link up to four different bank accounts to your single personal Venmo profile. Additionally, Venmo allows up to two different users to share a joint bank account to fund payments and receive transfers.

Violating the terms of service by maintaining two personal accounts can lead to a permanent ban from the platform, the freezing of your funds, and the loss of access to the service. It is a risk not worth taking.

An antidetect browser like Multilogin prevents cross-contamination by giving each Venmo account a unique, isolated digital fingerprint and a dedicated IP address (via a proxy browser). This makes each account appear to Venmo as a separate, legitimate user on a separate computer, eliminating the risk of a ban due to digital fingerprinting.

Yes, this is the only official way to have two accounts under your name. Venmo allows you to link a single Business Profile to your Personal Account to keep your professional and personal transactions separate.

No. Your Venmo Business Profile is linked to your existing Personal Account, so you do not need a separate phone number. However, you will need a separate email address for the business profile.

No. A standard VPN only changes your IP address, which is just one part of your digital fingerprint. Venmo’s advanced anti-fraud systems can still detect that all accounts are being accessed from the same device with the same browser fingerprint, which is a major red flag. For true safety, you need an antidetect browser like Multilogin to manage the entire digital fingerprint.

Conclusion: Don't Risk Your Accounts—Manage Them Like a Pro

We’ve established the rules: one personal account, one business profile, and multiple bank accounts. This is the official, safe path for basic separation.

But for those who need to scale—for professional client work, affiliate marketing, or e-commerce—relying on simple workarounds is a recipe for disaster. The digital world is watching, and your browser’s unique fingerprint is the key to your identity.

Don’t wait for the ban hammer to drop and risk losing access to your funds and your business operations. Take control of your digital identities today with the industry’s most reliable antidetect browser.

Ready to scale your operations without fear?

Get started with Multilogin and see how we provide the peace of mind and undetectability you need to achieve true multiaccount management.